Are Your Computers And Technology Covered?

More people in America are experiencing the joys, and conveniences, of today’s computers and technology than ever before. You’d be hard-pressed to find a household that doesn’t have one computer, or at least has a family member who owns a computer.

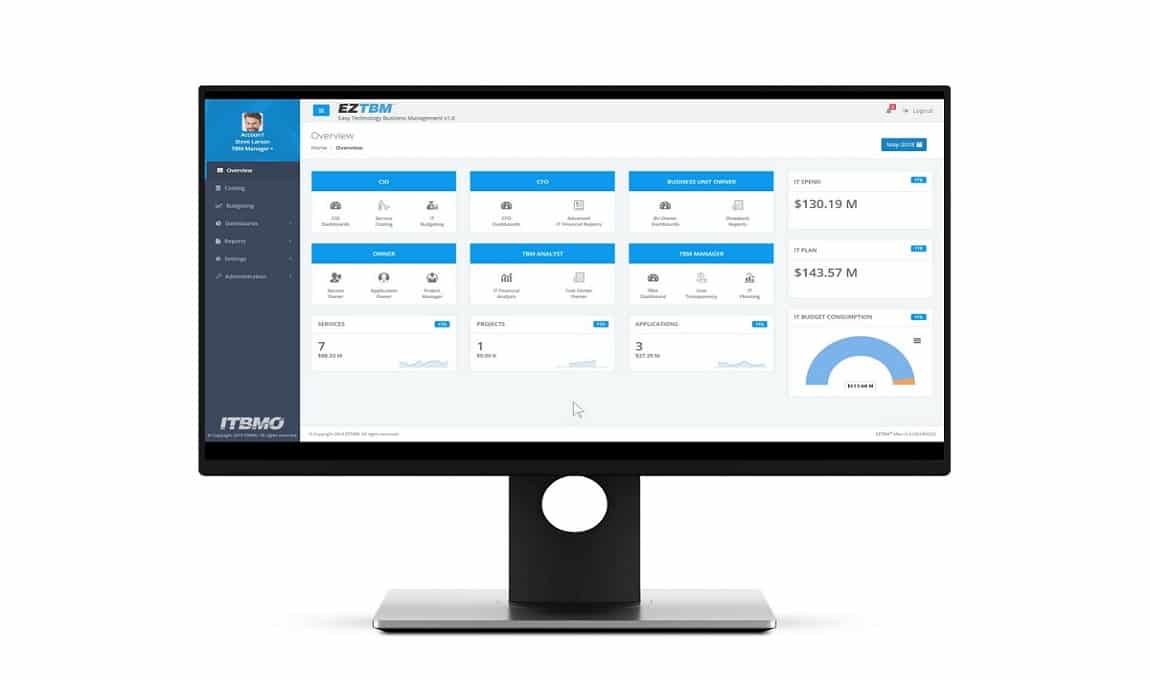

The technology that computers offer us is so useful, and many people use their computers for work, recordkeeping, and other such important tasks and information storage. So, if the homes the computers in which the computers are located catch fire, are severely damaged due to weather elements, or are robbed, how safe are the owners’ computers going to be?

Most homeowners’ insurance policies cover computers; however, coverage may be limited, and computer owners may want to consider purchasing additional insurance to cover their computers and technology losses in the event of an accident or emergency.

If you are a computer owner, and rely a good deal on the technology your computer offers, you might want to take a look at your homeowner’s insurance policy to find out exactly how much coverage is offered for your computer. If it’s not enough, think about purchasing additional coverage.

If your computer is used primarily for business-related purposes, you should look into additional coverage for the expenses necessary for data recovery; compensation for lost income while you computer is being repaired or replaced; and data recovery. Sometimes it’s essential to look into insurance policies made specifically for business-related issues when it comes to your computers and technology.

When choosing additional insurance coverage for your computers and technology, find out how much your deductible will be. If it’s less than what you’re willing to pay, you might want to increase it a bit; this will help keep your insurance premiums low.

Remember to always safeguard yourself by keeping all receipts for any repairs, replacements, data recovery, and upgrades you purchase in order to help the transaction between you and your insurance company go smoothly.